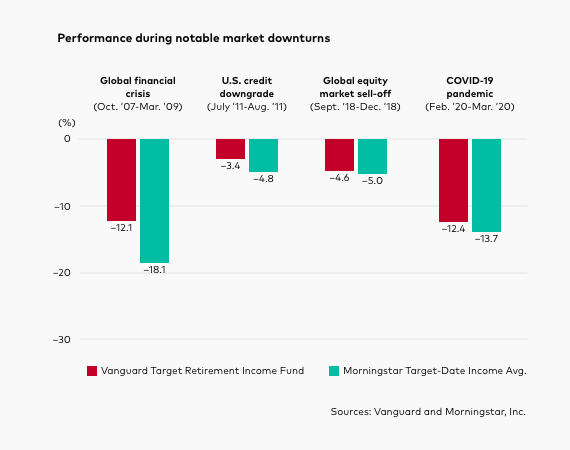

Sources: Vanguard and Morningstar, Inc., as of June 30, 2025. Results will vary for other time periods. Vanguard’s oldest share class (Investor Shares) and all funds in the Morningstar peer group with a minimum 10-year history were included in the comparison. There may be other material differences between products that must be considered before investing. Note that the competitive performance data shown represent past performance, which is not a guarantee of future results, and that all investments are subject to risks. Investment returns and principal value will fluctuate, so investors' shares, when sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data cited. For the most recent performance, visit our website at vanguard.com/performance.

Standardized performance

Vanguard Target Retirement Income Fund

Vanguard Target Retirement 2050 Fund